Blog Archive

News

Stock Forecasts

Wednesday, November 22, 2023

Friday, November 17, 2023

ZOM as of 17 November 2023 NL 423.42

The company also converted the preferred shares to common shares ending the overhang from the instruments, which were entitled to 9 percent royalty of the sales.

ZOM stock’s forecast looks positive if we stretch it to 2025.

In the past, I said that ZOM stock looks like a good long-term investment.

My only concern was with the price.

Daily trade volume 3.67 M

average volume 5.65

as of 03/20/2024

- Open0.1295High0.1350Low0.1295

- Mkt Cap130.14MP/E (TTM)N/ADiv & YieldN/A & N/A

- Prev. Close0.128052 Wk. Low0.120052 Wk. High0.2450

| ZOM | 718.2 $ |

| 798 sh | totalstock |

| $0.37 | market |

| $0.90 | avg |

| $423.42 | netloss |

| $294.86 | equity |

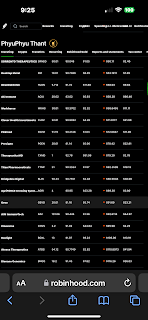

| ID | STOCK | REMARK PRICE | Field3 | PRICES | AMOUNT | Field1 | number | fill prices | fill dollar | total filled | total unit | average | NET LOSS | Field2 | REMARK |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 238 | zom | RH | $0.18 | 1200 | $221.28 | 1000 | $0.15 | $151.70 | $372.98 | 2200 | $0.17 | 0 |

| ID | STOCK | REMARK PRICE | Field3 | PRICES | AMOUNT | Field1 | number | fill prices | fill dollar | total filled | total unit | average | NET LOSS | Field2 | REMARK |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 281 | ZOM | RH | $0.90 | 798 | $718.20 | 10000 | $0.32 | $3,183.00 | $3,901.20 | 10798 | $0.36 | 0 |

| ID | STOCK | REMARK PRICE | Field3 | PRICES | AMOUNT | Field1 | number | fill prices | fill dollar | total filled | total unit | average | NET LOSS | Field2 | REMARK |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 174 | ZOM | DOWN LOWEST AT 0.1722 (12/02/2020) | RH | $0.19 | 1000 | $189.00 | 1000 | $0.13 | $130.00 | $319.00 | 2000 | $0.16 | 0 | GAP 0.3 | |

| 238 | ZOM | RH | $0.18 | 1200 | $221.28 | 1000 | $0.15 | $151.70 | $372.98 | 2200 | $0.17 | 0 | |||

| 281 | ZOM | RH | $0.90 | 798 | $718.20 | 5000 | $0.32 | $1,591.50 | $2,309.70 | 5798 | $0.40 | 0 |

Thursday, November 9, 2023

PLUG as of 11/4/2025

| ID | STOCK | REMARK PRICE | BROKER | DATE AND TIME | PRICES | AMOUNT | Field1 | number | fill prices | fill dollar | total filled | total unit | average | NET LOSS | Field2 | REMARK |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 316 | PLUG | RH | $3.78 | 50 | $189.00 | 500 | $2.68 | $1,340.00 | $1,529.00 | 550 | $2.78 | 0 |

as of 11 4 2025 Tuesday low volume 2.32 M avg volume 143.60M

open 2.79

high 2.72

low 2.61

today 4.0% down

Monday, November 6, 2023

FcEL as of Nov 6 2023

Current Price: $1.06 per share1.

Previous Close: $1.07 per share.

Day’s Range: $1.03 - $1.09.

52-Week Range: $0.98 - $3.03.

Market Cap: Approximately $478.97 million.

Earnings Date: Expected between June 6, 2024, and June 10, 2024.

EPS (TTM): Reported as -$0.26 in the most recent earnings call1.

Performance Outlook:

Short Term (2 weeks to 6 weeks): Neutral.

Mid Term (6 weeks to 9 months): Negative.

Long Term (9 months and beyond): Negative.

Fair Value Estimate: Not available.

Beta (5Y Monthly): 3.74.

Thursday, November 2, 2023

Subscribe to:

Comments (Atom)

to get in again

to get in again