Blog Archive

News

Stock Forecasts

Tuesday, December 8, 2020

unusual activity 12/08/2020

| Analyst Reports |

Search News |

Article Tools

Set News AlertCompanies Mentioned

| Symbol | Last | Change |

|---|---|---|

| AAL | $17.41 | +1.13% |

| ADT | $8.39 | +3.33% |

| BA | $236.45 | -0.72% |

| FCEL | $8.86 | +13.19% |

| LYFT | $46.49 | -0.14% |

9 Industrials Stocks Showing Unusual Options Activity In Today's Session

This unusual options alert can help traders discover the next big trading opportunities. Traders will search for circumstances when the market estimation of an option diverges heavily from its normal worth. Unusual trading activity could push option prices to exaggerated or underestimated levels.

Here's the list of some unusual options activity happening in today's session:

SymbolPUT/CALLTrade TypeSentimentExp. DateStrike PriceTotal Trade PriceOpen InterestVolume

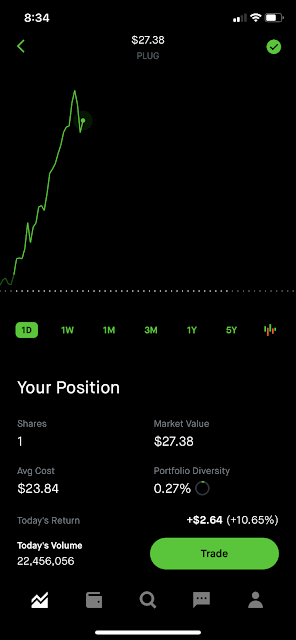

PLUGCALLSWEEPBULLISH12/18/20$30.00$35.2K9.8K32.2K

UBERCALLSWEEPBEARISH01/15/21$55.00$202.8K29.7K31.0K

NKLACALLSWEEPBEARISH12/18/20$23.50$38.2K14617.5K

SPCECALLSWEEPBEARISH01/15/21$35.00$105.0K45.7K8.3K

BACALLSWEEPBULLISH02/19/21$250.00$379.5K7.0K2.4K

FCELCALLSWEEPBULLISH12/18/20$7.00$35.4K5.4K1.8K

ADTCALLTRADEBEARISH02/19/21$7.50$29.8K3.1K545

LYFTPUTTRADEBULLISH01/15/21$47.50$93.6K613501

AALPUTSWEEPBULLISH01/21/22$8.00$30.7K166.5K261

Explanation

These itemized elaboration has been created using the accompanying table.

• Regarding PLUG (NASDAQ:PLUG), we observe a call option sweep with bullish sentiment. It expires in 10 day(s) on December 18, 2020. A trader bought 252 contract(s) at a $30.00 strike. This particular call needed to be split into 8 different trades to become filled. The trader or institution spent $35.2K on this trade with a price of $140.0 per contract. There were 9864 open contracts at this strike prior to today, and today 32201 contract(s) were bought and sold.

• For UBER (NYSE:UBER), we notice a call option sweep that happens to be bearish, expiring in 38 day(s) on January 15, 2021. A trader bought 676 contract(s) at a $55.00 strike. This particular call needed to be split into 37 different trades to become filled. The trader or institution spent $202.8K on this trade with a price of $300.0 per contract. There were 29797 open contracts at this strike prior to today, and today 31034 contract(s) were bought and sold.

• Regarding NKLA (NASDAQ:NKLA), we observe a call option sweep with bearish sentiment. It expires in 10 day(s) on December 18, 2020. A trader bought 847 contract(s) at a $23.50 strike. This particular call needed to be split into 62 different trades to become filled. The trader or institution spent $38.2K on this trade with a price of $45.0 per contract. There were 146 open contracts at this strike prior to today, and today 17555 contract(s) were bought and sold.

• For SPCE (NYSE:SPCE), we notice a call option sweep that happens to be bearish, expiring in 38 day(s) on January 15, 2021. A trader bought 250 contract(s) at a $35.00 strike. This particular call needed to be split into 4 different trades to become filled. The trader or institution spent $105.0K on this trade with a price of $420.0 per contract. There were 45736 open contracts at this strike prior to today, and today 8303 contract(s) were bought and sold.

• For BA (NYSE:BA), we notice a call option sweep that happens to be bullish, expiring in 73 day(s) on February 19, 2021. A trader bought 220 contract(s) at a $250.00 strike. This particular call needed to be split into 4 different trades to become filled. The trader or institution spent $379.5K on this trade with a price of $1725.0 per contract. There were 7017 open contracts at this strike prior to today, and today 2485 contract(s) were bought and sold.

• Regarding FCEL (NASDAQ:FCEL), we observe a call option sweep with bullish sentiment. It expires in 10 day(s) on December 18, 2020. A trader bought 200 contract(s) at a $7.00 strike. This particular call needed to be split into 20 different trades to become filled. The trader or institution spent $35.4K on this trade with a price of $179.0 per contract. There were 5436 open contracts at this strike prior to today, and today 1802 contract(s) were bought and sold.

• For ADT (NYSE:ADT), we notice a call option trade that happens to be bearish, expiring in 73 day(s) on February 19, 2021. A trader bought 245 contract(s) at a $7.50 strike. The trader or institution spent $29.8K on this trade with a price of $122.0 per contract. There were 3127 open contracts at this strike prior to today, and today 545 contract(s) were bought and sold.

• Regarding LYFT (NASDAQ:LYFT), we observe a put option trade with bullish sentiment. It expires in 38 day(s) on January 15, 2021. A trader bought 253 contract(s) at a $47.50 strike. The trader or institution spent $93.6K on this trade with a price of $370.0 per contract. There were 613 open contracts at this strike prior to today, and today 501 contract(s) were bought and sold.

• For AAL (NASDAQ:AAL), we notice a put option sweep that happens to be bullish, expiring in 409 day(s) on January 21, 2022. A trader bought 238 contract(s) at a $8.00 strike. This particular put needed to be split into 21 different trades to become filled. The trader or institution spent $30.7K on this trade with a price of $129.0 per contract. There were 166510 open contracts at this strike prior to today, and today 261 contract(s) were bought and sold.

Options Alert Terminology

- Call Contracts: The right to buy shares as indicated in the contract.

- Put Contracts: The right to sell shares as indicated in the contract.

- Expiration Date: When the contract expires. One must act on the contract by this date if one wants to use it.

- Premium/Option Price: The price of the contract.

For more information, visit our Guide to Understanding Options Alerts or read more news on unusual options activity.

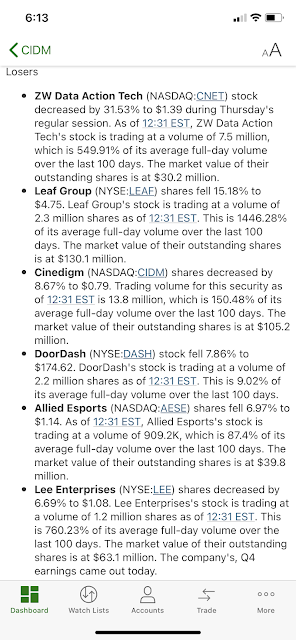

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reservedCIDM whats cidm doing ?

Cinedigm Corp., together with its subsidiaries, operates as distributor and aggregator of independent movie, television, and other short form content in the United States, Canada, and New Zealand. The company operates through two segments, Cinema Equipment Business and Content and Entertainment Business. It manages a library of distribution rights to various titles and episodes released across digital, physical, and home and mobile entertainment platforms, as well as services digital cinema assets on approximately 12,000 domestic and foreign movie screens. The company distributes its products for various brands, such as Hallmark, Televisa, ITV, Nelvana, ZDF, Shout! Factory, NFL, NHL and Scholastic, as well as international and domestic content creators, movie producers, television producers, and other short form digital content producers. It also collaborates with producers, various brands, and other content owners to market, source, curate, and distribute content to targeted audiences through existing and emerging digital home entertainment platforms, including Apple, Amazon Prime, Netflix, Hulu, Xbox, PlayStation, Sony, and cable/satellite video-on-demand; and

distributes DVD and Blu-ray discs to wholesalers and retailers with sales coverage to approximately 60,000 brick and mortar storefronts, including Walmart, Target, Best Buy, and Amazon.

In addition, the company operates various branded and curated over-the-top (OTT) entertainment channels, including Docurama, CONtv, and Dove Channel; and Matchpoint, a software-as-a-service platform to automate the distribution of streaming content and OTT channels.

Cinedigm Corp. has a strategic alliance with Starrise Media Holdings Limited to release films in China theatrically and to digital platforms.

The company was formerly known as Cinedigm Digital Cinema Corp. and changed its name to Cinedigm Corp. in September 2013.

3.3 Analyst's Opinion

Consensus Rating

Cinedigm has received a consensus rating of Buy. The company's average rating score is 2.50, and is based on 1 buy rating, 1 hold rating, and no sell ratings.

Price Target Upside/Downside

According to analysts' consensus price target of $2.75, Cinedigm has a forecasted upside of 257.1% from its current price of $0.77.

Cinedigm Corp. was founded in 2000 and is headquartered in New York, New York.

U.S. declined to buy more Pfizer Covid vaccine

U.S. declined to buy more Pfizer Covid vaccine doses, even after interim data, board member Gottlieb says

Understanding Plug Power's Unusual Options Activity12/07/2020

Understanding Plug Power's Unusual Options Activity

Plug Power (NASDAQ: PLUG) shares experienced unusual options activity on Monday. The stock price moved up to $25.24 following the option alert.

- Sentiment: BULLISH

- Option Type: SWEEP

- Trade Type: CALL

- Expiration Date: 2021-01-15

- Strike Price: $22.00

- Volume: 478

- Open Interest: 3388

Three Indications Of Unusual Options Activity

One way options market activity can be considered unusual is when volume is exceptionally higher than its historical average. The volume of options activity refers to the number of contracts traded over a given time period. Open interest is the number of unsettled contracts that have been traded but not yet closed by either counterparty. In other words, open interest represents the quantity of contracts that individual parties have written but not yet found a counterparty for (i.e. a buyer finding a seller, or a seller finding a buyer).

Another sign of unusual activity is the trading of a contract with an expiration date in the distant future. Usually, additional time until a contract expires allows more opportunity for it to reach its strike price and grow its time value. Time value is important to consider because it represents the difference between the strike price and the value of the underlying asset.

Contracts that are “out of the money” are also indicative of unusual options activity. “Out of the money” contracts occur when the underlying price is under the strike price on a call option, or above the strike price on a put option. These trades are made with the expectation that the value of the underlying asset is going to change dramatically in the future, and buyers and sellers will benefit from a greater profit margin.

Bullish And Bearish Sentiments

Options are “bullish” when a call is purchased at/near ask price or a put is sold at/near bid price. Options are “bearish” when a call is sold at/near bid price or a put is bought at/near ask price.

These observations are made without knowing the investor’s true intent by purchasing these options contracts. The activity is suggestive of these strategies, but an observer cannot be sure if a bettor is playing the contract outright or if the options bettor is hedging a large underlying position in common stock. For the latter case, bullish options activity may be less meaningful than the exposure a large investor has on their short position in common stock.

Using These Strategies To Trade Options

Unusual options activity is an advantageous strategy that may greatly reward an investor if they are highly skilled, but for the less experienced trader, it should remain as another tool to make an educated investment decision while taking other observations into account.

For more information to understand options alerts, visit https://pro.benzinga.help/en/articles/1769505-how-do-i-understand-options-alerts

Hydrogen-Powered Vehicles Usher in New Era of Transportation

Hydrogen-Powered Vehicles Usher in New Era of Transportation

Lithium demand has soared with the advent of electric vehicles, as severe supply shortages pose a serious threat to the long-term sustainability of the Battery Electric Vehicle ("BEV") transportation sector. However, another viable option for cleaner, cheaper and more sustainable transportation exists. Instead of battery-powered electric cars, vehicles powered with hydrogen, the most abundant resource in the universe, may be the key to truly disrupting the auto industry. The world is rapidly shifting away from the dwindling resource of fossil fuels, and hydrogen is expected to play a crucial role in slashing emissions and finally achieving sustainability. Hydrogen-powered electric vehicles are already commercially available with a multitude of cars, trucks and buses planned and in production. This tsunami of hydrogen-powered vehicles could turn the tide on dangerous emissions and usher in a new era of transportation -- if they can be fueled. While there's an abundance of hydrogen in the universe, there is a massive lack of hydrogen fueling stations, with less than 70 stations spread throughout the United States. The lack of hydrogen fueling stations is the primary impediment to rapid adaptation and presents an enormous opportunity. Recent developments at Clean Power Capital Corp. (CSE: MOVE) (OTCPK: MOTNF) (GERMANY: 2KGA) (Profile) could rectify this shortfall and may create a powerful force in facilitating the rollout of hydrogen vehicles across the nation. Clean Power Capital is an investment holding company that recently acquired a 90% equity stake in PowerTap Hydrogen Fueling Corp., a patented on-site hydrogen fueling intellectual property and technology that already has 14 installations around the country in private and public facilities. Plug Power Inc. (NASDAQ: PLUG) is credited for creating the first commercially market for hydrogen fuel cell technology and is building the hydrogen economy as a leading provider of comprehensive hydrogen fuel cell turnkey solutions and recently raised $1 billion for hydrogen investments. Ballard Power Systems Inc. (NASDAQ: BLDP) intends to deliver fuel cell power for a sustainable planet with its zero-emission PEM fuel cells that are enabling electrification of mobility, including buses, commercial trucks, trains, marine vessels, passenger cars and forklift trucks. Nikola Corporation (NASDAQ: NKLA) designs and will manufacture zero-emission battery-electric and hydrogen-electric vehicles, electric vehicle drivetrains, vehicle components, energy storage systems, and hydrogen station infrastructure. Hydrogen power goes beyond just transportation. FuelCell Energy Inc. (NASDAQ: FCEL) develops turnkey distributed power generation solutions, and operates and provides comprehensive services for the life of power plants for utilities and industry.

-- BEVs not nearly as sustainable as touted.

-- The shift to clean, safe, abundant and sustainable hydrogen power underway.

-- A myriad of new hydrogen vehicles are coming.

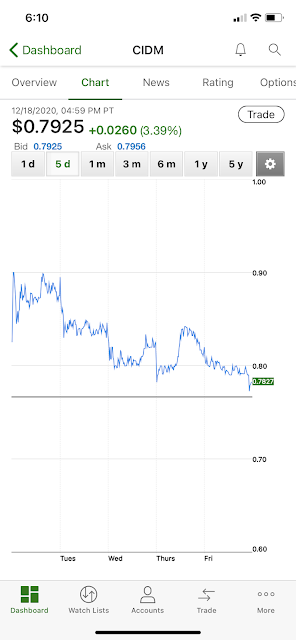

CIDM FORECAST NOW UP UNTIL 0.84

Given the current short-term trend, the stock is expected to fall -14.82% during the next 3 months and, with a 90% probability hold a price between $0.35 and $0.66 at the end of this 3-month period.

CIDM 12/08/2020

Cinedigm Partners With Spherex to Expand International Content Distribution Capabilities

-Deal to Leverage Spherex's AI Expertise for Global and Cultural Content Relevance-

SANTA CLARA, CA / ACCESSWIRE / December 8, 2020 / Spherex, a global entertainment technology and data company, announced today a strategic partnership with Cinedigm (NASDAQ:CIDM) to accelerate Cinedigm's international expansion. The companies are partnering on global content localization and compliance, deploying Spherex's AI and machine learning capabilities.

As part of Cinedigm's ongoing efforts to monetize its extensive digital content catalog, the company has selected Spherex to utilize its technology and expertise to ensure its video assets and metadata are compliant with international regulations for content age ratings and optimized to adhere to prevailing cultural norms and practices across a wide range of international territories.

Through an integration with its proprietary Matchpoint® platform, Cinedigm is tapping into Spherex's industry-leading global metadata solution to adapt its digital content across a growing number of subscription video on demand (SVOD), advertising-based video on demand (AVOD) and Smart TV streaming platforms worldwide.

"We are excited to leverage Spherex's expertise in local market sensibilities and to utilize their AI technology to help pave our expansion into international markets," said Tony Huidor, General Manager of Cinedigm Networks. "Having an assurance that our digital content is compliant with best practices and territorial laws around age-rating and cultural norms is critical to the success of our video streaming services and aids consumers in their search and discovery of our channels."

"Helping companies navigate the complicated and treacherous international landscape is at the very core of our business," said Spherex CEO Teresa Phillips. "Cinedigm's rapid international expansion requires an expertise that combines technology and localization know-how."

2-2-2: Spherex-Cinedigm

As content explodes worldwide, Spherex is building a gold standard to track, monitor, customize and monetize IP as it is licensed around the world and across platforms. Using its AI technology, the team at Spherex will work with Cinedigm to guide their international licensing and enable them to geo-adapt content and references to match the cultural sentiment in targeted countries.

ABOUT SPHEREX

Spherex is a global entertainment technology and data company transforming how media and entertainment enterprises create, adapt and deliver film and television to audiences worldwide through AI and machine learning. With unmatched expertise in cultural adaptation, ratings, metadata and title monitoring, Spherex works with the world's largest media companies, movie studios, networks, distributors and streamers to build larger audiences, speed up content discovery, drive more video views and generate higher revenue. Learn more at www.spherex.com.

ABOUT CINEDIGM

For more than twenty years, Cinedigm (NASDAQ: CIDM) has led the digital transformation of the entertainment industry. Today, Cinedigm entertains hundreds of millions of consumers around the globe by providing premium content, streaming channels and technology services to the world's largest media, technology and retail companies.

Cinedigm uses, and will continue to use, its website, press releases, SEC filings, and various social media channels, including Twitter, LinkedIn,Facebook,StockTwits and the Company website as additional means of disclosing public information to investors, the media and others interested in the Company. It is possible that certain information that the Company posts on its website, disseminated in press releases, SEC filings, and on social media could be deemed to be material information, and the Company encourages investors, the media and others interested in the Company to review the business and financial information that the Company posts on its website, disseminates in press releases, SEC filings and on the social media channels identified above, as such information could be deemed to be material information. For more information, visit http://www.cinedigm.com.

Contacts:

Bronagh Hanley on behalf of Spherexbronagh@bignoisepr.com415-314-7262

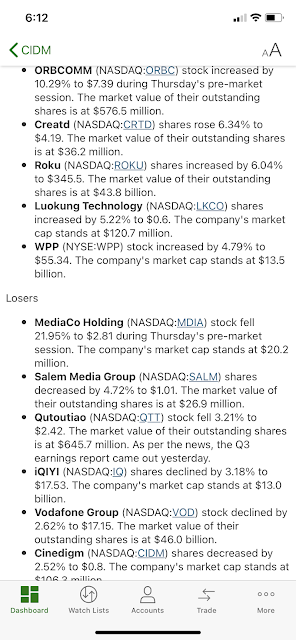

CIDM news trading higher

Cinedigm Reports Partnership With Spherex To Expand Int'l. Content Distribution Capabilities, No Terms Disclosed

|

|

Search News |

Cinedigm Reports Partnership With Spherex To Expand Int'l. Content Distribution Capabilities, No Terms Disclosed

Spherex, a global entertainment technology and data company, announced today a strategic partnership with Cinedigm (NASDAQ:CIDM) to accelerate Cinedigm's international expansion. The companies are partnering on global content localization and compliance, deploying Spherex's AI and machine learning capabilities.

As part of Cinedigm's ongoing efforts to monetize its extensive digital content catalog, the company has selected Spherex to utilize its technology and expertise to ensure its video assets and metadata are compliant with international regulations for content age ratings and optimized to adhere to prevailing cultural norms and practices across a wide range of international territories.

Through an integration with its proprietary Matchpoint® platform, Cinedigm is tapping into Spherex's industry-leading global metadata solution to adapt its digital content across a growing number of subscription video on demand (SVOD), advertising-based video on demand (AVOD) and Smart TV streaming platforms worldwide.

"We are excited to leverage Spherex's expertise in local market sensibilities and to utilize their AI technology to help pave our expansion into international markets," said Tony Huidor, General Manager of Cinedigm Networks. "Having an assurance that our digital content is compliant with best practices and territorial laws around age-rating and cultural norms is critical to the success of our video streaming services and aids consumers in their search and discovery of our channels."

"Helping companies navigate the complicated and treacherous international landscape is at the very core of our business," said Spherex CEO Teresa Phillips. "Cinedigm's rapid international expansion requires an expertise that combines technology and localization know-how."

2-2-2: Spherex-Cinedigm

As content explodes worldwide, Spherex is building a gold standard to track, monitor, customize and monetize IP as it is licensed around the world and across platforms. Using its AI technology, the team at Spherex will work with Cinedigm to guide their international licensing and enable them to geo-adapt content and references to match the cultural sentiment in targeted countries.

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

More Benzinga headlines

KeyBanc Makes Bull Case For ON Semiconductors As New CEO Takes Over

KZL

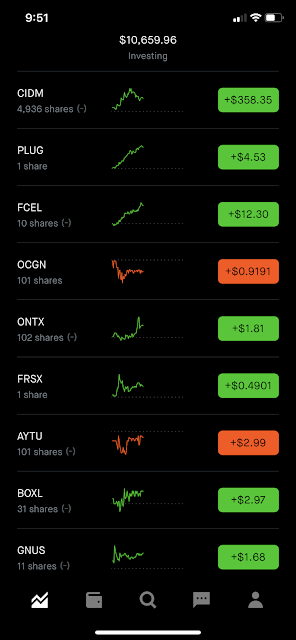

| ID | STOCK | PRICES | AMOUNT | Field1 | number | fill prices | fill dollar | total filled | total unit | average | Field3 | Field2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 91 | OGEN | $0.45 | 3000 | $1,356.90 | 1000 | $0.45 | $448.10 | $1,805.00 | 4000 | $0.45 | 0 |